The democratisation of private markets is under way. The National Pension System NPS was launched on 1st January 2004 with the objective of providing retirement income to all the citizens.

Beginner S Guide To Private Retirement Schemes Prs In Malaysia

ICICI Bank offers fixed term deposit with monthly income option for resident individuals singly or jointly with flexible options.

. Receive 30 amount as lump sum on maturity of the investment and remaining 70 as a monthly income. Exclusive to company directors. The PERE Global Investor 100.

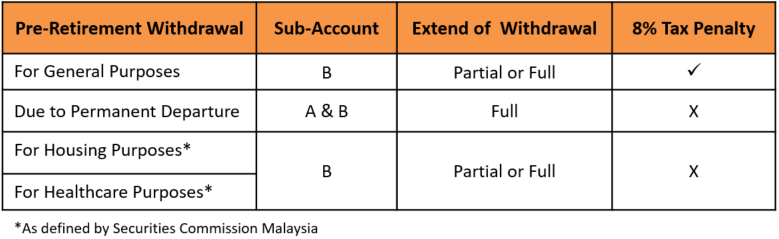

The transfer is voluntary for members. Many people choose to retire when they are elderly or incapable of doing their job due to health reasons. Key terms and methodology.

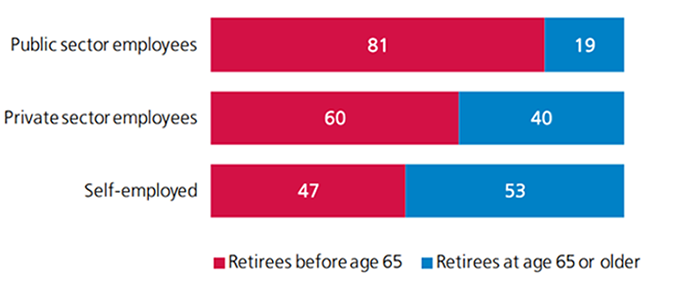

A Good Alternative for People in Private Jobs. 03 2022 6900 E-mail. Only upon reaching the retirement age of 55 years or in the case of death or emigration can withdrawals be made from the PRS account.

Most public sector workers were moved into a new pension scheme called alpha In 2018 the Court of Appeal found that some of the rules put in place back in 2015 to protect older workers by allowing them to remain in their original scheme were discriminatory on the. 03 2022 6800 Facsimile. For investment in the Senior Citizen Savings.

Developed using ground breaking technology rated outstanding by you our customers we deliver a seamless fast and better self administered pension scheme for you and your wealth. The Laptrust DB Scheme closed its doors to new members in 2012 and in a new Defined Contribution Scheme Laptrust Umbrella Retirement Fund was registered to meet the retirement needs of new employees within the then Local Authorities of Kenya. Applicants older than 55 years but lesser than 60 years can also open Post Office Senior Citizen Saving Scheme if they have taken voluntary retirement or have retired on superannuation subjected to terms and.

78 Jalan Raja Chulan 50200 Kuala Lumpur Malaysia. Senior Citizen Saving Scheme SCSS is a post office saving scheme for senior citizens above the age of 60 years. Women in Private Funds 2022.

Arizona State Retirement System. HDFC Bank is a young and dynamic bank with a youthful and enthusiastic team determined to accomplish the vision of becoming a world-class Indian bank. Law firm data submission.

The Mandatory Provident Fund Chinese. Unlike the public sector where the central or state allocates a certain percentage of the salary towards pension there is. Each year youll pay in 98 of your annual salary and your employer will put in 216.

The RED 50 2022. We offer a comprehensive range of products comprising conventional and Shariah-based unit trust and PRS funds as well as financial planning services. Behind the latest PE and private debt fundraising numbers.

Post Office Senior Citizen Savings Scheme SCSS 2022. Like with EPF PRS contributions are also divided 7030 into two sub-accounts. Since 1 July 2013 individuals may be able to transfer their retirement savings held by their superannuation providers between Australia and New Zealand after emigrating from one country to the other.

This pension is applicable for employees that take up voluntary retirement from bank. HDFC Bank Indias leading private sector bank offers Online NetBanking Services Personal Banking Services like Accounts Deposits Cards Loans Investment Insurance products to meet all your banking needs. Apply for a fixed deposit monthly income plan for a tenure of your choice.

Update your database profile. 2021 Global PERE Awards and Annual Review. Government of India established Pension Fund Regulatory and Development Authority PFRDA - External website that opens in a new window on 10 th October 2003 to develop and regulate pension sector in the country.

The minimum service period required to qualify for VRS pension scheme is. 強制性公積金 often abbreviated as MPF 強積金 is a compulsory saving scheme pension fund for the retirement of residents in Hong KongMost employees and their employers are required to contribute monthly to mandatory provident fund schemes provided by approved private organisations according to their salaries and the period. PRS is similar to the Employees Provident Fund EPF in that it is a retirement scheme.

Retirement Income Policy into the Next Century Howe1989 December 1989. Public Mutual Berhad 197501001842 23419-A Menara Public Bank 2 No. Retirement is the withdrawal from ones position or occupation or from ones active working life.

Sub-Account A and Sub-Account B. Fixed Deposit Monthly Income Scheme. In 2015 the government introduced reforms to public service pensions.

When you and your employer start contributing to USS you automatically begin to build benefits in the Retirement Income Builder the defined benefit part on your salary up to the salary threshold. His experience extends to managing PublicPrivate Partnership PPP initiatives bringing. Nice and clear for everyone.

Fonds de Reserve Pour. Public Mutual Berhad a wholly-owned subsidiary of Public Bank is a top private unit trust management company and leading PRS provider in Malaysia. How a Democrat-controlled US government could impact private equity.

Our business philosophy is based on five core values - Operational Excellence Customer Focus Product Leadership People and. How private equity can unlock value in technology. HDFC Bank Customer Care Number 1800 202 6161 1860 267 6161 Accessible across India Get in touch with us for your Banking needs on our helpline number.

Private Real Estate Data. Public Pension Agency Saudi Arabia. Pension on Voluntary Retirement.

Trans-Tasman retirement savings portability scheme for individuals. ESG-linked fund finance sustainability step-change or window. Easy online set up and no tie in.

Introducing the PERE 200. Indiana Public Retirement System. LIC pension plans are a good way to earn pensions for people employed in the private sector.

ICICI Banks Senior Citizens Savings Scheme SCSS is a Government of India Product this product is one of the most Safest Investment Option also provides 9 high interest rate to its depositors. A person may also semi-retire by reducing work hours or workload. The Governments 1989 retirement income policy statement established a policy in Australia based on the twin pillars of the age pension and private superannuation specifically rejecting the option of a National Superannuation Scheme.

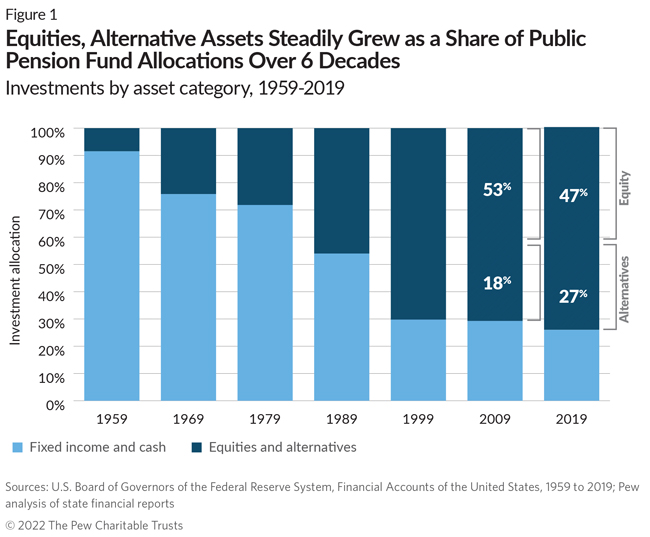

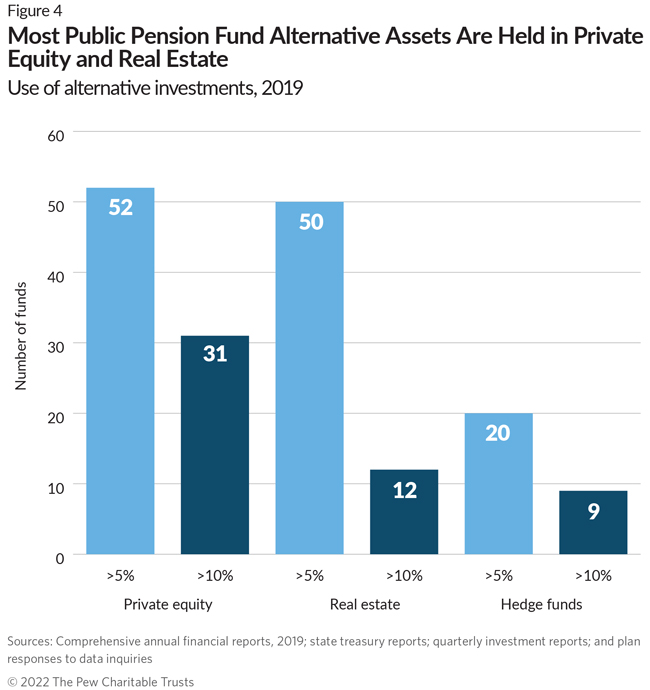

State Public Pension Fund Returns Expected To Decline The Pew Charitable Trusts

Prs Provider Public Mutual Berhad Private Pension Administrator Malaysia Ppa

Which Prs Funds To Invest In 2020 2021 Mypf My

Cover Story Is Prs Outperforming Epf The Edge Markets

Beginner S Guide To Private Retirement Schemes Prs In Malaysia

State Public Pension Fund Returns Expected To Decline The Pew Charitable Trusts

A Guide To The Private Retirement Scheme Prs

Public Bank Berhad Unit Trust Private Retirement Scheme

:max_bytes(150000):strip_icc()/dotdash-investmentbank_vs_merchantbank-Final-919a2920abc645518abb9c8620ae5cad.jpg)

Investment Banks Vs Merchant Banks What S The Difference